One of the biggest challenges that Accounts Payable departments face is not only identifying employee fraud and misuse—which on its own can be a daunting task—but also being able to do so across all the various expenses and expense pay methods used by the company.

Various expenses and methods of payment mean various ways to commit fraud and misuse

Businesses have several types and categories of employee expenses. Most commonly, they include travel and entertainment (T&E), training, office supplies and equipment, and vendor manufacturer purchases.

Then there are the methods that employees use to pay for such expenses: purchasing cards (P-Cards), travel cards, and an employee’s own out-of-pocket funds.

For AP managers and staff, keeping tabs over all these various expenses and payment methods across the board can be challenging. Next, factor in all of their other tasks and responsibilities. Now the struggle is more than real — it can be downright dangerous to the financial health of the company.

Inundated by different transactions, receipts trails, and payment pathways, AP departments find themselves running the risk of allowing one or more of these expense categories or payment methods to fall through the cracks and go unreviewed. That ends up leaving the door open to employee fraud and misuse that goes undetected.

The unturned stones that hide employee fraud and misuse

These “unturned stones” of transactions that end up either getting ignored or simply forgotten by those responsible for their review can generate greater opportunities for employees to commit and get away with expense fraud or payment method misuse.

Just what might AP reviewers be missing? What might these unturned stones be hiding? Here are just a few examples of employee fraud and misuse that can escape an overburdened AP team, and the payment methods that might be used as well to commit the acts:

Duplicate payments.

Probably the most common of employee (and vendor) expense offenses is duplicate payment. Also known as “double billing,” duplicate payment occurs when the same transaction for the exact same products or services is deliberately submitted for billing twice.

While this can occasionally be a matter of careless error on the part of the vendor, it’s just as typical that the employee and vendor have teamed up to commit fraud. The two are in cahoots — with the vendor offering the employee a cut as a reward for his or her role in the scheme.

The assumption these parties make is that, due to the extreme amounts of transactions being made between this vendor and this company or even more specifically, this employee, a duplicate bill and payment will slip by unnoticed.

In other words — both the employee and the vendor are trying to take advantage of exactly what AP management fears the most: that because there are so many transactions and so many means of paying for them, something is bound to get lost. They’re literally banking on this happening.

But just as true is that this is a very easy transaction to locate and identify — assuming, of course, that someone is looking. Two bills will cross an AP desk. Two invoices exist. Digital and paper receipts of payment all exist as well. It’s a matter of connecting the dots, or in this case, the invoices and receipts. But when you’ve got a host of responsibilities and hundreds — or maybe even thousands — of receipts to go through and compare each month, it’s really not as simple as it sounds.

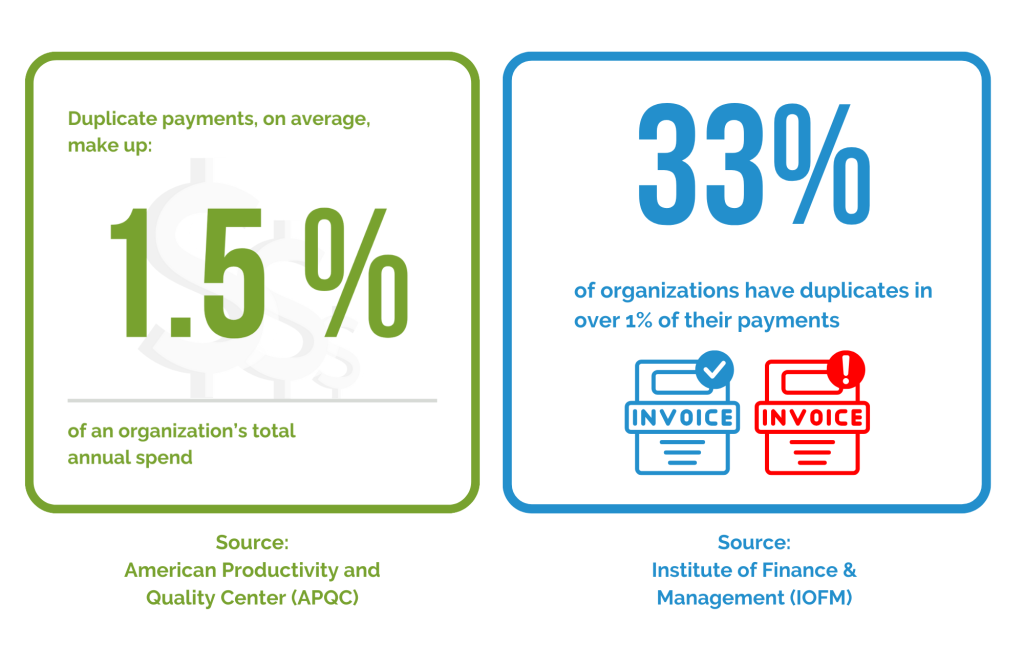

Sources:

- “Identifying and Eliminating Duplicate or Erroneous Payments in Accounts Payable” published by the American Productivity and Quality Center (APQC)

- “Next Generation Accounts Payable with AI-Led Automation” published by the Institute of Finance & Management (IOFM)

Lying about true cost of the expense.

In an attempt to receive more money, the employee might inflate the true cost of the expense, and pocket the leftover funds of the reimbursement.

This sort of fraud can occur using just about any payment method, but if it’s done using a P-Card or a ghost card with a vendor (read more about ghost accounts), there will be an easily obtainable digital paper trail that ultimately reveals the original transaction, that will fail to jive with the employee’s expense report. In the case of a cash transaction, employees should always be turning in receipts with the expense report. Failing to do so, in and of itself, should present a red flag and should not be tolerated by company management, as an infringement against what ought to be written company policy.

Without checking receipts against the reimbursement claim, this sort of employee fraud could be easily overlooked.

Over-ordering inventory.

In this case, whether purchasing office supplies or production equipment, an employee orders more inventory than is necessary, and then returns some of the items back to the vendor. He or she then keeps the refunded money. If only one transaction is accounted for, but the return itself is never noted, the employee truly makes off like a bandit.

Again, especially in the case of P-Cards and ghost accounts — the digital receipts that should be easily and solely accessible by AP management can tell the tale. But if AP is relying only on physical receipts to be turned in, an employee can always claim he or she “forgot” to do so, putting into question whether the behavior was deliberate fraud or just the employee’s poor but unintentional practices.

Personal purchases.

This runs the gamut, from buying airline tickets and hotel rooms to purchasing more unusual items, such as toiletries or even baby diapers.

When these purchases are in the form of something seemingly legit, such as T&E expenses, a weak review system could easily let such fraudulent expenses slip. This is especially true if the payment method used was one assigned specifically for T&E, such as travel cards.

In such cases as the ones listed above and those that go beyond this list, it’s easy to see that, while resources are available via most modern payment methods to help prevent employee fraud and misuse, if those resources are not used by those within AP, such tools become meaningless.

The struggle is real, but so is the solution

While the struggle is real, the good news is that the overwhelm that many AP departments fear and actually experience can be overcome.

AP management is always concerned with the entire payment process. Helping AP departments stay on top of that process, with all of the different business expenses and ways to pay for them, is what Card Integrity does best. Through our monitoring services, we combat employee financial fraud by identifying red flags across all kinds of expenses and all types of payment methods.

We do what many AP departments simply don’t have the resources to do: We handle the review of literally thousands of transactions a month, and we do so by examining 100 percent of the company’s expense data. There is no stone left unturned.

Perhaps most important of all—our services uncover the dreaded duplicate payment, protecting your company from current fraud, as well as future overpayments.

Download the Invoice Review Best Practices White Paper

Check out the white paper below to learn about how Card Integrity’s Invoice Review service uncovers duplicate payments across multiple sources, including Accounts Payable functions, out-of-pocket expenses, and P-Cards.

Article originally published January 30, 2019. Updated February 18, 2025 with more recent, relevant information.